Write to us

info@comofashion.de

Contact form

Call us**

Monday to Friday 08:00 - 18:00

08031 809540

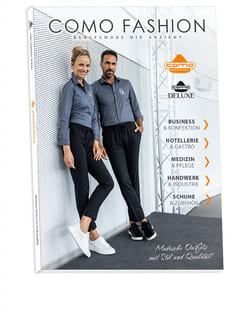

Order our catalog

Catalog order

** The usual charges of your telephone provider apply.

Can workwear be tax-deductible?

Claim professional clothing for tax purposes

It is not always easy and straightforward to claim professional clothing as a tax deduction from the tax office. A clear prerequisite as a business expense would be if the clothing cannot be used in the same way in everyday life and if it is the bearer of a corporate identity or serves for protection during work. Our article under http://www.betriebsausgabe.de/berufsbekleidung.html reports on this in detail. But in some cases such a classification is not so easy to make. An example of this is the black and white evening dress for professional musicians. An orchestra, too, often has to present a uniform appearance and is not allowed to have colourful splashes of colour on stage. And so many concert halls opt for a black-and-white wardrobe for their staff. Of course, this would also be applicable in everyday life, but not every day from morning to night, but at most in exceptional cases.

Workwear is exempt from VAT

According to section 8 (2) EStG, workwear, which can also be used in everyday life, represents a non-cash benefit for employees. As a benefit in kind, this is taxable for the employee. If, on the other hand, the clothing is typical work clothing or legally required protective clothing, it is tax-exempt and is clearly considered a business expense. The employer is also not liable for wage tax if the workwear is to be uniformly designed in the company for reasons of corporate identity. Workwear is exempt from VAT if it is necessary for business reasons. If the clothing is not typical for the profession, the costs for the purchase, maintenance or cleaning of this clothing do not count as income-related expenses according to Sec. 12 No. 1 Sentence 2 EStG. They must be included in the expenses for general living expenses. This also applies if the clothes are only worn at work.